Furniture maker to launch higher-margin own brand called Collino Designs

AFTER a quarter-century of manufacturing and designing furniture for its customers, Wegmans Holdings Bhd will launch its own furniture brand targeting China and the larger Asian region.

Called “Collino Designs”, the new venture marks the Muar-based company’s strategy to diversify into higher-margin business.

With Wegmans making 99% of its revenue through exports, the launch of its own brand will be key in capturing a wider exposure overseas.

Wegmans aims to make a RM50mil turnover from its new furniture brand business in three years. For context, the Ace Market-listed company recorded a revenue of RM86.2mil in its financial year of 2017 (FY17).

In an interview with StarBizweek, Wegmans co-founder and executive director Collin Law Kok Lim says the cost of investment for the new business will be minimal, estimated at RM100,000 per annum.

He adds that the Collino Designs furniture will be the key catalyst in lifting the revenue contribution from China, moving forward.

“Currently, only 4% of our revenue comes from China. We strongly believe that with the Collino Designs, we can raise the revenue share from China to 20% in three years,” says Law, who is also the lead designer of Wegmans.

Collino Designs will be launched next month during the Malaysian International Furniture Fair – the largest furniture trade fair in South-East Asia.

Wegmans will unveil four furniture ranges of different themes simultaneously, with each range comprising furniture items for the living, dining and bedroom.

More than 100 home furniture items will be introduced under the Collino Designs, all of which are designed using Wegmans’ in-house expertise.

“Going forward, we will produce three to four furniture ranges every year, depending on the demand.

“Our products will be offered at an upper-medium price range, making them affordable and at the same time, high quality. We plan to start our sales in May and aggressively expand the business,” he says.

Called “Collino Designs”, the new venture marks the Muar-based company’s strategy to diversify into higher-margin business.

With Wegmans making 99% of its revenue through exports, the launch of its own brand will be key in capturing a wider exposure overseas.

Wegmans aims to make a RM50mil turnover from its new furniture brand business in three years. For context, the Ace Market-listed company recorded a revenue of RM86.2mil in its financial year of 2017 (FY17).

In an interview with StarBizweek, Wegmans co-founder and executive director Collin Law Kok Lim says the cost of investment for the new business will be minimal, estimated at RM100,000 per annum.

He adds that the Collino Designs furniture will be the key catalyst in lifting the revenue contribution from China, moving forward.

“Currently, only 4% of our revenue comes from China. We strongly believe that with the Collino Designs, we can raise the revenue share from China to 20% in three years,” says Law, who is also the lead designer of Wegmans.

Collino Designs will be launched next month during the Malaysian International Furniture Fair – the largest furniture trade fair in South-East Asia.

Wegmans will unveil four furniture ranges of different themes simultaneously, with each range comprising furniture items for the living, dining and bedroom.

More than 100 home furniture items will be introduced under the Collino Designs, all of which are designed using Wegmans’ in-house expertise.

“Going forward, we will produce three to four furniture ranges every year, depending on the demand.

“Our products will be offered at an upper-medium price range, making them affordable and at the same time, high quality. We plan to start our sales in May and aggressively expand the business,” he says.

The Collino Designs furniture will be marketed using the same business-to-business model, which has been Wegmans’ modus operandi over the years.

Its target customers are furniture wholesalers, retailers, traders and chain stores.

“While we will look for new clients, the focus will be mostly on our existing customers in selling our products under the Collino Designs.

“We have established long-term relationships with our key customers, spanning between seven and 16 years. As most of our target customers know about our services and quality, we believe home furniture under Collino Designs will see positive acceptance,” says Law.

Moving forward, Wegmans will continue to expand its original design manufacturing (ODM) business.

Under the ODM business, Wegmans provides designing and manufacturing services for furniture sold under its customers’ brand. The design is by its in-house designing team.

Collino Designs, on the other hand, will be the company’s original brand manufacturing (OBM) business. The designs, manufacturing and branding will all be done by Wegmans.

Wegmans has a strong competency in the furniture ODM scene, with over 90% of the company’s sales coming from ODM-related services.

From 2019, Wegmans will begin to offer its ODM services for the local market. This is expected to strengthen the revenue contribution from the ODM segment.

“We have identified a new partner in Malaysia to provide our ODM services. The partner is a public-listed company.

“This also marks our strategy to diversify our revenue stream,” says Law.

Established in 1994, Wegmans is an export-based home furniture manufacturer, with a workforce of 600 employees.

The group exports to more than 70 countries across Asia, North America, Europe, Australia, South America and Africa.

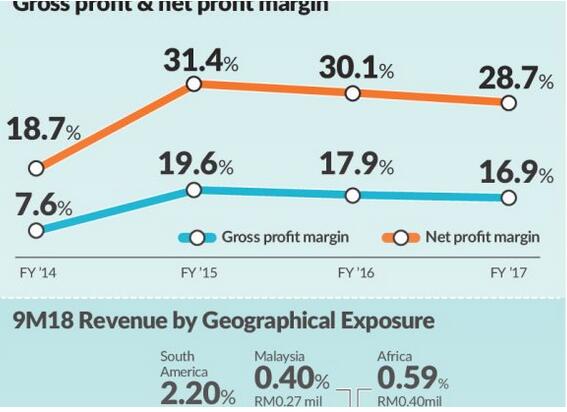

Over the past three years, between the financial years of 2014 and 2017, the company’s revenue and profit after tax and non-controlling interest grew at compounded annual growth rate of 30% and 70% respectively.

Meanwhile, its four-year average gross profit margins stood at 27%.

Wegmans made its debut on the Ace Market on March 6, 2018 when it opened at 30.5 sen, which was 1.5 sen above its offer price of 29 sen.

The company raised RM29mil from its offer of 100 million new shares.

Law and Wegmans co-founder and managing director Keh Wee Kiet own a 35% equity interest each in Wegmans, leaving a public float of 30%.

Aggressively growing

As part of its growth strategy, Wegmans has put in place a three-phased multi-year expansion plan.

The group plans to develop its 21 acres in Muar, which was purchased in 2016, over three phases.

The first phase, covering 10 acres, is currently under development. Wegmans will build a new factory, headquarters and a hostel for its workers under the first phase.

With the completion of the new factory, Wegmans’ production capacity will be effectively doubled. The production in the new factory is expected to start in the third quarter.

Currently, the company has an annual capacity of 480,000 chairs and 190,000 dining tables. The existing production plant is running at almost full capacity.

According to Law, the construction of Wegmans’ new factory under phase one is almost completed. Meanwhile, the hostel and the office building are 50% and 5% done respectively.

“We allocated RM25mil capital expenditure for the first phase, including the equipment. A total of RM22mil from the listing proceeds and RM3mil from our internally-generated funds.

“We have utilised up to RM20mil of the allocated sum,” he says.

Law points out that Wegmans’ production capacity will double by the first half of 2020.

On the expected timeline to begin the development of phase two and three on the 21 acre, Law says there are no immediate plans but it will depend on the demand for the company’s OBM products, particularly from China.

Main Market listing

On the company’s listing status, Law says Wegmans aims to apply to transfer its listing to the Main Market by the end of the year.

“It is our intention to apply to transfer our listing status by year-end, once all the requirements are met,” he adds, adding that the submission process for the transfer has been done.

Being an export-oriented furniture maker, Wegmans’ profitability relies on the global trade and currency conditions.

Law says that the company has benefited from the strengthening US dollar as about 99% of its sales are exports denominated in the greenback.

Meanwhile, about 95% of its costs are denominated in ringgit.

Between April and November 2018, the US dollar has continued to strengthen against the ringgit, rising by almost 8.7% during the period.

“We believe our revenue in the current FY19 will see a strong double-digit growth, supported by a strong US dollar, greater supply from our new plant and demand for our new OBM business.

“Any exchange rate of above RM4 per US dollar is comfortable for us. On the flip side if there is a sharp weakening weakening of the US dollar, we may try to increase our selling prices.

“However, if the impact from US dollar weakening is small and manageable, we will absorb it,” says Law.

Despite the rise in US dollar for the most of last year, the currency began to weaken against the ringgit from end-November 2018. Up till the middle of this month, the greenback has depreciated by 2.8% against the ringgit.

Wegmans has benefited from the US-China trade spat, mainly due to the trade diversion from China.

In 2018, the United States was Wegmans’ biggest exporting country, as compared with Japan in 2017.

Within the first nine months of 2018, 30% of Wegmans’ total sales were contributed by the United States, up from 21% for the full-year 2017.

“US buyers are worried about the 25% tariff that may be imposed by the US government on furniture from China. So, as they look for other suppliers outside of China, Wegmans is a beneficiary. We have confirmed orders from the United States.

“Even if the trade war ends without any tariff imposed, we expect our US customers to remain with us,” says Law.

Moving forward, Law opines that the contribution from the United States will continue to grow.

Asked why investors should consider Wegmans shares, Law says the stock holds more value, given the company’s growth plans and production capacity expansion.

Based on the figures provided by the company, its latest price-to-earnings (PE) ratio is about 12 times. The company expects its PE ratio to improve significantly once its production capacity doubles, which would potentially raise the group’s revenue and bottom line.

Since its listing last year, the stock has risen by about 21%. Currently, Wegmans’ market capitalisation stands at RM172.5mil, based on its closing share price of 34.5 sen yesterday.

In the first nine months of FY18, the furniture maker recorded a net profit of RM6.37mil, against a revenue of RM67.2mil. There are no comparative figures for the preceding corresponding period.

(Source: klsescreener.com)

沪公网安备31010402003309号

沪公网安备31010402003309号