China and Southeast Asia's Furniture Industry

Some time ago, ANZ Bank released a report forecasting that because of the cheap labor advantage in Myanmar and other countries along the Mekong River will replace China as “The Factory of the World” within in the next 10 - 15 years.

Some time ago, ANZ Bank released a report forecasting that because of the cheap labor advantage in Myanmar and other countries along the Mekong River will replace China as “The Factory of the World” within in the next 10 - 15 years.

The Japanese media has been very excited about this news. Fuji Business News and The Nikkei Business Daily have provided extensive coverage, reporting that there are extensive investment prospects for certain businesses in Southeast Asia.

In fact, despite all the hype in the media, the business community in general has not expressed such excitement, as not many enterprises have considered moving to Southeast Asia from China. At least it has not yet become a trend. The head of a Japanese-owned electronics factory in Shenzhen, said: “A few years ago we considered moving our facility to Vietnam because of the increased labor costs in China. But we found that there are drawbacks such as frequent power outages which make normal production difficult. Meanwhile, the local market is small in Vietnam, so our products can only be exported.”

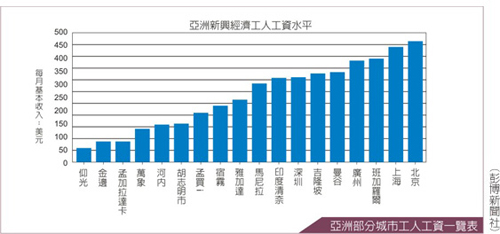

ANZ Bank has provided a graph comparing the wage levels (US$ per month) of emerging Asian economies: As printed in the Bloomberg News, the cities in the graph are listed in order as Yangon, Phnom Penh, Dhaka, Vientiane, Hanoi, Ho Chi Min, Bombay, Cebu, Jakarta, Manila, Chennai, Shenzhen, Kuala Lumpur, Bangkok, Guangzhou, Bangalore, Shanghai and Beijing.

Wages are certainly a very important factor for production in these places, but not the only factor. Others include:

─ Government policies

─ Infrastructure

─ Up/down supply chains

─ Domestic markets

─ Materials

─ Factory real-estate availability

As regards the furniture industry, we first look at the situation in Southeast Asia.

According to ANZ Banking Group economists research, by 2030 Southeast Asia will have a population of 650 Million people, of which more than half will be under 30 years old, and the emerging middle class will have a lot of spending power.

We can put the ten ASEAN countries into three groups:

• The first group: Myanmar, Cambodia, Laos and Indonesia.

• The second group: Malaysia, Thailand, Vietnam and the Philippines.

• The third group consists of Singapore and Brunei.

In the third group Singapore is already ranked as a first world country. Wages are very high and land is very limited, so the furniture industry does not stand to develop much. Brunei has a population of merely 200,000 to 300,000, and cannot engage in the production of furniture, so the third group is insignificant regarding the furniture industry.

The second group consists of moderate developing countries with a certain foundation. Furniture exports from Vietnam has reached 10% that of China. Malaysia also has a strong production capacity. The following are some statistics these countries show this year.

Although Vietnam ranks in the second group, it is not a member of the CAFA(Council of Asia Furniture Associations), and therefore we do not have their import and export data. We do know that it exports about 10% of China's 50 billion US dollar export value, which still ranks it as the largest furniture exporter in Southeast Asia.

Among the second group of countries, Vietnam began to undertake part of the Chinese production ten years ago as a result of the United States' anti-dumping duties towards China, particularly solid wood bedroom furniture. In recent years, Vietnam's upstream supply chain has been becoming increasingly complete, with higher availability of MDF, paint and hardware. Rubber wood costs only 1600-1800 RMB per square foot, 2,000 RMB cheaper than China. These are some factors that show great potential for Vietnam.

Other countries in the second group have great potential in furniture production as well, given their local governments' willingness to help develop their furniture industries. They already have strong foundations in furniture production, such as the Philippines' high quality rattan furniture, teak furniture in Thailand and Malaysian dinettes. They are doing very well and offer a strong price advantage.

Except for Indonesia, the first group along the Mekong River including Cambodia, Laos, and Myanmar all offer very low wages. Labor is abundant, but their furniture industry is not yet industrialized. Most still remain at the manual workshop stage.

Indonesia ought to belong in the second group, but we take into account that their industrialization and mechanization is at a relatively low level, so it ranks in the first group. In fact, the development of Indonesia's furniture industry has very favorable conditions:

These include strong timber resources with a wealth of tropical hardwood forests of mahogany, teak and so on. Since an early ban on log exports, domestic timber prices are cheap.

Land Supply is very adequate. There are no laws separating industrial sectors from agricultural land, so many factories are actually on farmland. Because of the hot tropical climate, plants often only consist of just pillars and roofs, so building costs are very low.

Human Resources are very adequate. Indonesia has a population of nearly 400 million, and with ten thousand large and small islands, there are many workers and world-class craftsmen skilled in carving.

It is said that many duty issues are easily discussed and resolved with the villagel chieftains or mayors, making it easy to produce furniture. With conditions being so good, the question arises as to why the furniture production in Indonesia is lower than that of Malaysia. It may very well be a lack of entrepreneurship in the local mentality.

During our visit last year to Jepara, Semarang in Indonesia, we noticed very simple tools, much hand-carving and simple wood drying methodology.

When asked why they do not have equipment, the answer is almost always the same: "What do we do if we invest in equipment, but we get no orders?" They prefer to build furniture entirely by hand. A company from Singapore built a modern drying kiln in Jepara, and the result was it got torched at midnight.

Apparently everyone is subject to mutual supervision, so no one dares to be the first to undertake modernization. Thus, export customers cannot purchase furniture made with improperly dried wood. It's a vicious cycle. Today, Indonesian furniture exports amount to just over a billion USD, equal to only a fraction of China's exports.

After thirty years of rapid development, China's furniture industry has surpassed those of Southeast Asian countries, with a total export of more than 50 billion US dollars.

China is the leading importer among Asian countries, and the entire total exports of Southeast Asian furniture is not even half of China's total exports. But in recent years, the development of China's furniture industry has seen some problems:

Because of increases in wages and Total Factor Productivity figures (TFP) do not match, there has been a rise in the cost of operations.

The employment of unskilled workers results in low productivity per capita compared to that of developed countries. It causes difficulties in finding enough workers.

Education has not kept pace. There are not enough mechanical and traditional training schools. This is leading to a dwindling amount of skilled carpenters as well as intelligent equipment operators. For CNC production, program writers will be sorely lacking.

The following data may perhaps more vividly illustrate where the problem lies:

1. China's furniture production is between two to three times that of the United States. Americans say they produce about 50 percent of China's production, but that is doubtful. Whether it be custom made or decorative furniture, as with any type they are using hardware made in other countries. This raises the question of whether the end product was really just made in the United States alone. Even a twist of a screw in the United States on furniture made elsewhere deems it US made. We believe that only the custom made or decorative furniture is really made in US. In fact, US domestic production is more equivalent to 30-40% of China's total production. They have merely 4,972 companies in operation. On the other hand, China has more like 60,000, which is about but a dozen times the amount of furniture factories. This leads to the problem of productivity and yield.

2. Japan's output of furniture production is about one-tenth of China's, but they only employ over 100 thousand workers, while China employs 2.5 million workers in the furniture industry. From the perspective of productivity per capita, the Japanese are 4-5 times superior.

From the above data, it can be said that there are too many furniture factories and small enterprises in China, and they are using too much labor. To sum it up, if China can increase productivity and maintain the amount of skilled workers, there would be no shortage of labors and its costs should not be too high.

Chinese enterprises are currently restructuring and upgrading, but they cannot disregard the advantages of traditional manufacturing in this transformation. The critical point is that during this upgrading, intelligent manufacturing and green manufacturing should become priorities.

As for GDP per capita, Japan's furniture industry produces one million RMB or more, 4-5 times higher than China's. China still has a long way to go in upgrades to increase productivity. The only way Southeast Asia can surpass China is if the Chinese people stand still. But that is not the case.

Southeast Asian countries and China can complement each other. China can benefit from special types of material resources other countries have, such as rattan from Indonesia. There are some bans on the export of materials from the Mekong River Basin, such as mahogany, but they can produce components locally and export furniture and fittings to China.

Some people are already engaged in these activities, and it is believed that some people will join in, so there is no need to deliberately integrate them.

-

Furniture Industry in China Faces the Crisis of Excess Production Capacity

-

West China Furniture Industry Area Faces to the Tertiary Market in Midwest China

-

Ali Design Week: Chen Baoguang (CNFA) with Analysis on China Furniture Industry and Design Development

-

North China Furniture Industry Area: the Largest Distributing Center of Classical Furniture in Northern China

沪公网安备31010402003309号

沪公网安备31010402003309号