In buying retailer DWR, office-furniture maker Herman Miller aims to reach consumers

Herman Miller knows times have changed, and it can no longer rely so heavily on selling office and institutional furniture to Fortune 1,000 companies and government agencies.

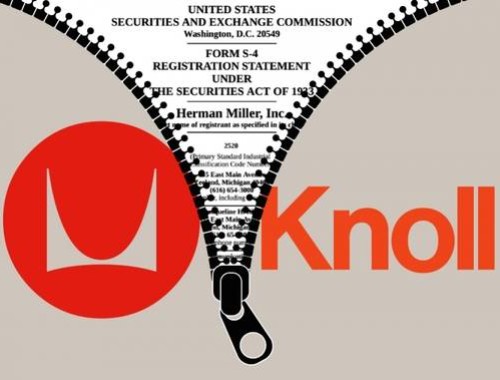

The company’s purchase of Design Within Reach is a key step toward Chief Executive Brian Walker’s goal of transitioning the Zeeland, Mich., company, primarily known as a wholesaler, into what he described as a “lifestyle brand.” The company, in short, hopes to sell more of its often-iconic furniture and other wares into not just homes but schools, doctor’s offices, restaurants and more.

“We realized if we don’t do something, we are going to be left behind in a shrinking pie,” Walker said during the company’s investor presentation on Thursday. “How do we follow [the consumer] through [the] day?”

Herman Miller, like office-supplies retailers Staples Inc. SPLS and Office Depot Inc. ODP , is seeking growth outside of its bread-and-butter business as governments have cut budgets and as mobile devices change the way people work and use office equipment and furniture.

As part of the evolution, open work spaces, in which workers are more free to interact and collaborate, are increasingly replacing cubicles — themselves a Herman Miller innovation.

Herman Miller has been more than an observer of this trend. It has hired in-house baristas to staff its employee coffee bar, where, as one executive has reported, many a big decision is now made. The company also has remodeled its office space to give it a residential feel and moved away from cubicles and conference rooms to “coves,” “creative rooms” and “zen space” for contemplation.

With Design Within Reach, which had $218 million in sales last year through 38 stores, its website and a print catalog, Herman Miller acquires the potential to expand its consumer business to $500 million over the next few years, compared with an earlier projection of $150 million to $175 million, according to internal projections. Herman Miller said its consumer business currently contributes about $68 million to annual sales. That translates to the segment’s being responsible for about 3.4% of the company’s approximately $2 billion in sales.

DWR

The U.S. consumer furniture business, though, is about 10 times the size of the office-furniture business, and it’s also, in the view of Herman Miller, a “less volatile” segment. And furniture, according to Herman Miller, is a category where physical stores remain an important distribution channel.

That’s where Design Within Reach, Herman Miller’s biggest retail customer before the acquisition, comes in. Walker acknowledged that, while Herman Miller is good at research and design, it’s not good at marketing. “We didn’t have deep consumer experience,” he said.

For its part, Design Within Reach has undergone its own reinvention. Delisted in 2009 by the Nasdaq only five years after going public, Design Within Reach has reinvigorated its operation under CEO John Edelman and President John McPhee. They took over in 2010, shuttering more than 40% of all DWR stores after previous management’s overly aggressive expansion depleted available capital. The new team has also increased the proportion of proprietary designs offered and has moved headquarters to Stamford, Conn., from San Francisco. The business turned profitable in the team’s second year.

The pair also began to open bigger stores that they said generate more sales per square foot because they allow better display of products in more realistic lifestyle settings. Rival Restoration Hardware, which has outperformed the broader retail segment, has been building larger stores for the same reason.

Design Within Reach also began to target interior designers and architects more pointedly, and sales to the trade have grown to 27% of all DWR business from just 2% under prior management. It also began to focus more tightly on store locations to optimize exposure and foot traffic. For instance, its newest store in Chicago is located just steps from an Apple Store. (A smaller location had existed for a number of years just a stone’s throw away.)

Herman Miller wasn’t oblivious to DWR’s makeover. In fact, Walker said one of the conditions of the buyout was that Edelman and McPhee stay on to run the business unit and convert their ownership interests in Design Within Reach to stakes in a newly formed Herman Miller consumer wing.

“We are buying because of what’s in your head and your vision,” Walker recalled telling the DWR leadership team.

沪公网安备31010402003309号

沪公网安备31010402003309号