Nankang solid wood furniture price index rose by 1.94% in the first half of the year

Source:shuliangtec.com

The market of Nankang solid wood furniture industry has recovered steadily and the development momentum is good.

Affected by the rising costs of raw materials and transportation costs, the solid wood furniture price index in the first half of 2021 rose steadily, with a cumulative increase of 1.94%; the industrial development index fluctuated and fell, with a cumulative decline of 2.74%; the industrial prosperity index was always in a high boom range. The solid wood furniture industry market in Nangkang is steadily recovering, and the development momentum is good.

Timber price index operation

From the perspective of the timber market, log price trends in the first half of 2021 were ups and downs. After timber futures rose to their peak in May, as supply increased, speculative trading activities cooled, residential demand gradually slowed, and affected by high temperatures and rainfall, domestic construction industry has entered the traditional off-season, and the decline in demand has affected the high price of the log market. (Data source: China Timber Price Index Network).

Domestic log price index fluctuates down

In 2021, the domestic log price index fluctuates, but it is still at a high level.

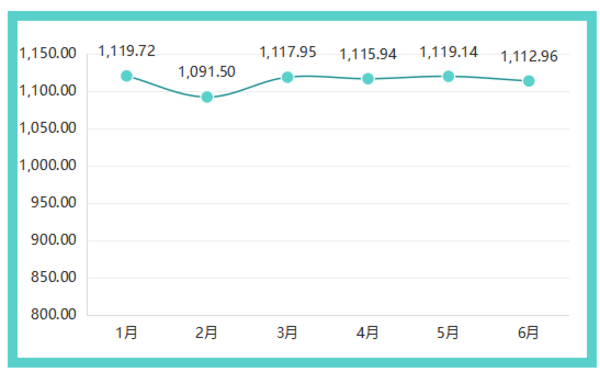

Domestic log price index trend

On the whole, the domestic log price index closed at 1,119.72 points in January, the highest point in the first half of the year. After that, the Spring Festival holiday effect appeared in February, and the market showed a strong "closed" mood. The domestic log price index dropped significantly, month-on-month a decline of 28.22 percentage points. Among them, the market prices of Fraxinus mandshurica logs, Pinus sylvestris logs, and oak logs fell to varying degrees. At the end of February, compared with the end of January, the price per cubic meter fell by 100 yuan, 30 yuan, and 150 yuan, respectively. Oak saw the largest decline. 3.53%.

After a dormant rest in February, the domestic timber market' s bull market pattern officially opened, and the domestic log price index rebounded from a low level, up 26.45 percentage points from the previous month. The subsequent fluctuations were relatively small. As of June, the building materials industry was overwhelmed by market stagflation in the off-season, and domestic timber merchants were under pressure to operate, and the domestic log price index shrank and adjusted, and finally closed at 1112.96 points, a cumulative decline of 6.76 percentage points in the first half of the year. Looking at the futures market, the June lumber futures rally reversed rapidly. Timber futures fell by more than 40%, marking the largest decline since 1978, but they have not yet returned to their pre-epidemic levels.

Some analysts believe that the current risks of domestic timber prices and demand falling are still within the controllable range, but we must also be fully vigilant, because the tight supply and high prices in overseas markets have successfully suppressed the increase in domestic demand. At present, the downstream market has a strong wait-and-see sentiment. The market management concerns caused by the shrinking demand have begun to spread. The lack of demand power in the downstream market has begun to exert an impact on domestic timber transactions. Only the downstream market has hedged against the impact of rising and falling prices. With enough patience, we can better resist the risk of unexpected stagflation.

The price index of imported logs fluctuates and rises

In the first half of 2021, the price index of imported logs fluctuated upward.

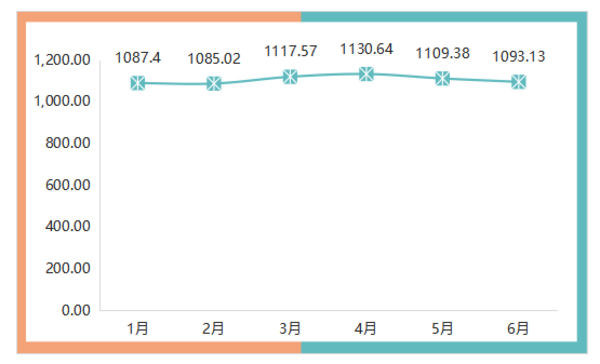

Imported Log Price Index

In terms of price index, affected by the Spring Festival in February, the building materials market was in a "closed" state, and the price index of imported logs ushered in a short-term decline, then fell to rise, and continued to rise to close at 1130.64 points in April, the peak of the first half of the year.

Entering the second quarter, as the weather gets hotter, the operating rate of outdoor infrastructure projects has dropped significantly, the downstream market demand continues to be weak, and new goods are continuously added. The timber market inventory is becoming more and more sufficient, and the problem of early supply shortage has been solved. Significantly alleviated, and the price has also been corrected due to this. From May to June, the price index of imported logs continued to decline, closing at 1,093.13 points as of June.

Compared with the same period last year, due to the impact of the epidemic, timber processing plants were once closed, resulting in a decrease in supply. Superimposed on the surge in demand for new and improved housing in the United States, the imbalance between supply and demand has driven timber prices soaring. In the first half of 2021, timber prices have seen an all-round red, and the increase has been significant.

In the future, as the supply gradually catches up with the demand, the spot market price is gradually in a correction mode, and the price growth rate will slow down. The year-on-year increase of the imported timber price index from May to June has narrowed, but it is still higher than the same period last year. .

Interpretation of the price index of solid wood furniture

Entering 2021, the upstream wood logging and board production in the furniture industry have dropped by 30%, leading to increasingly serious wood shortages. The price once rushed up, setting new records almost every day. This phenomenon is called the "timber crisis" by industry insiders". The rise in timber prices has pushed the solid wood furniture price index upward slowly.

In the first half of 2021, the solid wood furniture price index rose steadily as a whole.

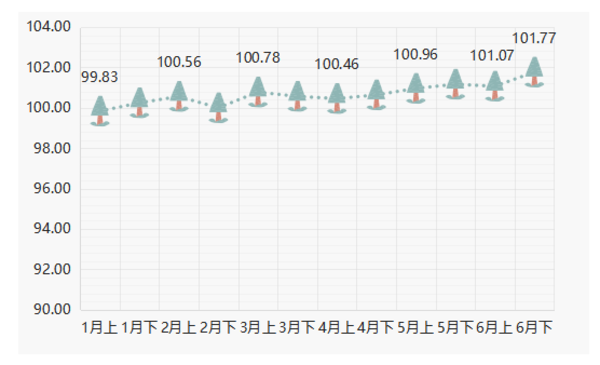

Solid wood furniture price index trend

In view of the solid wood furniture market, the furniture is a consumer-resistant product, and the price fluctuations are relatively moderate. The solid wood furniture market in the first half of the year showed a steady upward trend. In the first quarter, the solid wood furniture price index started at a low level. The index closed at 99.83 points in January, and then maintained an upward trend, and both closed at more than 100 points. Among them, the index fell sharply in the second half of February, down 0.56 percentage points.

In the second quarter, from April to May, the solid wood furniture price index continued to rise, closing at 101.17 points in the second half of May, showing strong resilience; after a short 0.10 percentage point drop in the first half of June, it finally rushed in the second half of the month. To the peak of the first half of the year, it closed at 101.77 points, a cumulative increase in the first half of the year.

On the whole, the scarcity of raw materials and the continuous increase in demand have led to rising prices of solid wood furniture. From the perspective of the log market, the price of a piece of New Zealand pine has increased by 40% from the beginning of the year, but it is still in short supply, which has compressed the company' s profit margin to a certain extent.

The price index of civil furniture has risen overall

In the first half of 2021, the civil furniture price index has generally risen, and the overall operation has been stable.

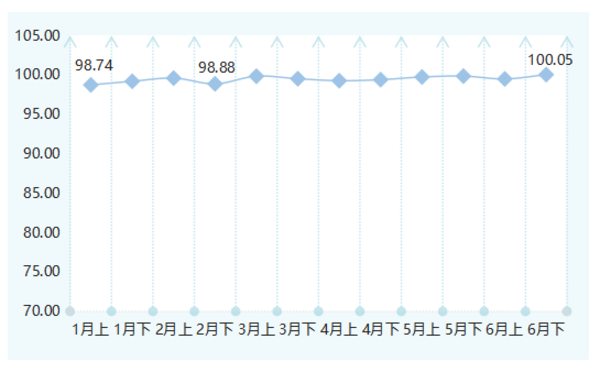

The trend of the price index of civil furniture

Affected by the increase in log prices, the international furniture market has risen, and the overall price has risen. Relevant data show that in April 2021, US civilian furniture orders increased by 239% year-on-year, which was an 11-month consecutive year-on-year increase.

From the index monitoring results, in the past six months, the performance of the civil furniture price index is consistent with the overall index. In the first half of January, it closed at a low level. In the second half of February, the price index of civil furniture fell relatively sharply, closing at 98.88 points, a decrease of 0.72 percentage points. Subsequently, it fluctuated between 99.00-100.00. As of the second half of June, the civil furniture price index finally closed at 100.05 points, which is the first time this year that it rose above 100 points.

Office furniture price index rose steadily

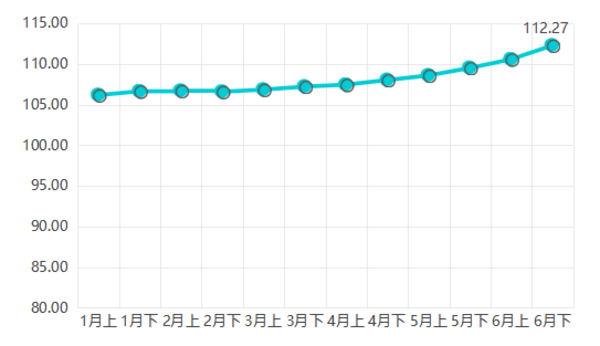

In the first half of 2021, the office furniture price index rose steadily, and the overall performance was gratifying.

Office furniture price index trend

Compared with traditional furniture, office furniture has the characteristics of versatility, humanization, individualization, and diversification. The sudden outbreak of the epidemic has changed the normal office of consumers. Under the new situation, office furniture has ushered in new development opportunities.

In the past six months, the office furniture price index has risen steadily. Except for the slight decline of 0.12 points in the second half of February, the office furniture price index has risen to varying degrees in the rest of the year. As of the second half of June, the index closed at 112.27 points, a cumulative increase of 6.10 percentage points in the first half of the year.

From the perspective of the consumer market, consumers' pursuit of quality improvement has become an important engine for my country' s consumption upgrade. At present, more and more business places and office spaces have higher and higher requirements for the function, material and design of the overall supporting furniture. Not only the office furniture is required to meet the high quality, strong functionality, but also have the creative design of space aesthetics. Integrating with the overall office space, the quality of office furniture has improved year by year, and has become an important support for its price increase.

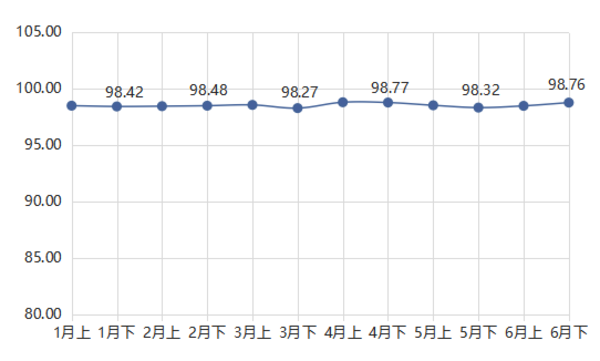

Outdoor furniture price index is generally up

In the first half of 2021, the outdoor furniture price index has operated relatively smoothly, with an overall increase.

Outdoor furniture price index trend

With the continuous development of the outdoor leisure industry, the domestic market' s demand for outdoor furniture products has gradually increased, and the outdoor furniture market has gradually heated up. In the first quarter, from the first half of January to the first half of March, the outdoor furniture price index rose and fell moderately, basically fluctuating between 0.03% and 0.07%, and there was a slight downward trend in March, closing at 98.27 points, a month-on-month decrease of 0.29 %.

In the second quarter, the outdoor furniture price index ushered in an upward trend. The first half of April closed at 98.79 points, an increase of 0.53% from the previous month, and then continued a slight downward trend to close at 98.32 points in the second half of May. Entering June, the outdoor furniture price index turned down to rise, closing at 98.76 points in the second half of the month, a slight increase of 0.27 percentage points in the first half of the year.

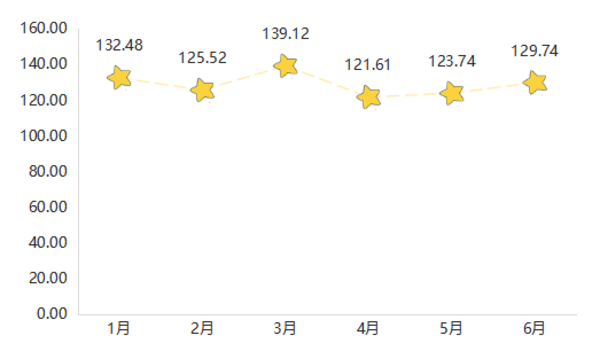

Interpretation of Industry Development Index

In the first half of 2021, the solid wood furniture industry development index continued to fluctuate at a high level.

Industry Development Index Trend

On the whole, the industrial development index in the first quarter was above the second quarter as a whole.

In the first quarter, the industrial development index showed a downward trend and then recovered. The solid wood furniture industry development index closed at 132.48 points in January, and then declined slightly. In March, the performance rebounded and closed at 139.12 points, which was the peak of the first half of the year.

In the second quarter, with the coming of the furniture industry' s off-season, the solid wood furniture industry development index fell back from a high level in April, but then continued to rise, showing strong resilience. As of June, it closed at 129.74 points, a cumulative decline of 2.74% in the first half of the year.

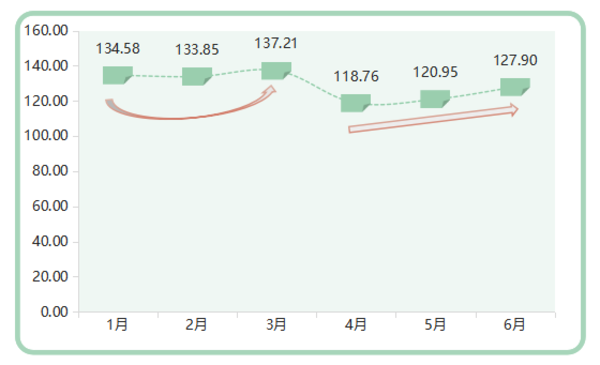

Industry scale index fluctuates downward

In the first half of 2021, the scale index of Nankang' s solid wood furniture industry fluctuates and declines.

Industry scale index trend

On the whole, the industrial scale index in the first half of the year was operated in two stages, and it was consistent with the performance of the industrial development index. In the first stage, driven by the increase in the number of employees and the continued growth of the furniture industry, the overall scale of Nankang' s solid wood furniture industry is growing. The industry scale index closed at 137.21 points in March, a cumulative increase of 2.63 percentage points.

In the second stage, due to the continuous growth of the output value of the furniture industry, the cumulative increase in the first half of the year was 21.82%, which promoted the continued upward trend of the industry scale index. It closed at 127.90 points in June, a cumulative increase of 9.14 percentage points in the second quarter.

Compared with the first quarter, due to the gradual off-season of home building materials, the consumption momentum of residents declined. In the second quarter, the industrial scale index position was low, but it still showed a sustained growth trend, indicating that the Nankang solid wood furniture industry scale index is full of resilience.

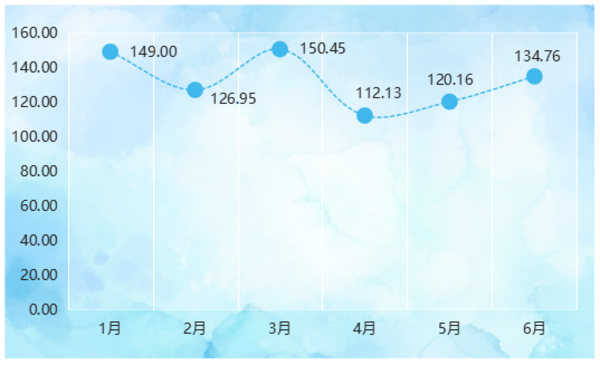

The economic benefit index fluctuates downward

In the first half of 2021, the economic benefit index of solid wood furniture fluctuated and declined.

Economic benefit index trend

In the first quarter, the economic benefit index of solid wood furniture rebounded after falling and remained at a high level overall. Among them, in March, driven by the increase in GDP per mu, furniture industry income, and labor productivity, the economic efficiency index reached its peak in the first half of the year, closing at 150.45 points, an increase of 18.51% from the previous month.

In the second quarter, the furniture market transaction atmosphere was relatively cold, and the economic efficiency index declined significantly. However, after April, it continued to maintain a strong upward trend, and economic benefits increased considerably. As of June, it closed at 134.76 points, a cumulative decline of 14.24 percentage points in the first half of the year. In the future, the off-season effect gradually fades, the autumn furniture industry will gradually improve, and the economic efficiency index is expected to maintain growth.

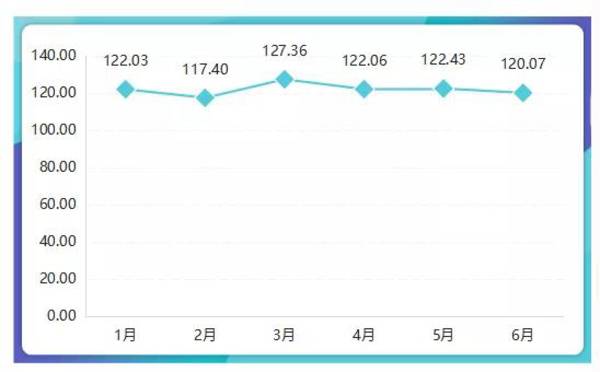

The operating capability index fluctuates alternately

In the first half of 2021, the operating capability index will fluctuate alternately, with a slight decrease overall.

Operating Capability Index Trend

In the first quarter, Nankang' s solid wood furniture business rebounded after falling, but the overall performance was good, closing at 127.36 points in March, a cumulative increase of 5.33 percentage points in the first quarter.

In the second quarter, the furniture market ushered in the off-season, and the weak downstream consumption momentum led to the decline in the operating capacity of furniture companies. The operating capacity index closed at 122.06 points in April, down 4.16% from the previous month; after a slight increase in May, the operating capacity index began to decline slightly in June Downward, it closed at 120.07 points, a slight decrease of 1.96 percentage points in the first half of the year.

The design innovation index rises in volatility

In the first half of 2021, the Nankang Solid Wood Furniture Design Innovation Index fluctuated upward.

Design innovation index trend

In recent years, Nankang' s solid wood furniture industry has continuously explored the path of innovation and transformation and made breakthrough progress. In the first quarter of 2021, the design innovation index performed brilliantly. The index continued to rise from January to March. As of March, the design innovation index closed at 136.73 points, an increase of 14.92% from the previous month.

In the second quarter, the design innovation index continued the good momentum of the first quarter, and continued to maintain a low growth rate in April, closing at 139.65 points, rising to the peak in the first half of the year. The design innovation index fell back slightly in May, down 5.03 percentage points from the previous month, while the index maintained horizontal changes in June. On the whole, the operating capacity index increased significantly in the first half of the year, with a cumulative increase of 19.60%, indicating that the overall operating capacity of Nankang furniture enterprises is strong.

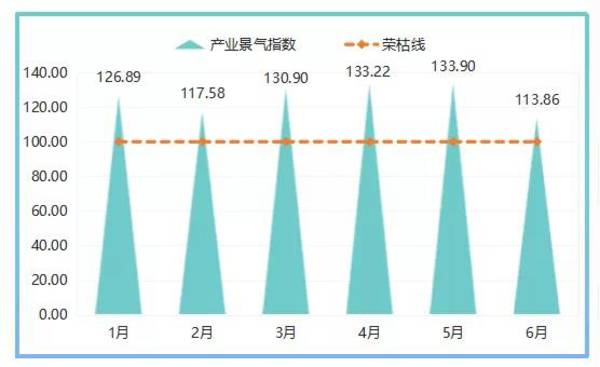

Interpretation of Industry Climate Index

In the first half of 2021, the solid wood furniture industry prosperity index performed well, and the overall performance was above the line of prosperity and decline.

The trend of the industry prosperity index

On the whole, under the influence of factors such as rising log prices and insufficient consumption motivation, furniture companies still showed a high degree of confidence, and the prosperity index of the solid wood furniture industry in the first half of the year was all above 100 points.

In June, affected by the off-season, the furniture market has cooled down, the order volume and profit margin have declined slightly, and the industry prosperity index has returned to a higher economic range.

The source has been identified in this article. All copyrights belong to the original anthor. In case of infringement, please contact us.

沪公网安备31010402003309号

沪公网安备31010402003309号