Qumei Home Released 2018 Semi-Annual Report: Net Profit Fell 33.33%, New Strategy Encountered Resistance?

On August 21st, Qumei Home released the new retail tour of 2018 Qumei, which was just beginning. Whether it can rely on digital transformation to get out of the pressure of net profit growth is still to be proved.

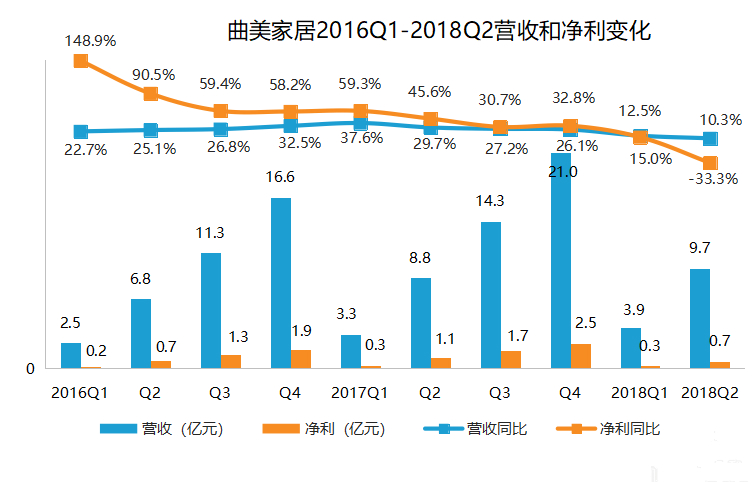

On the afternoon of August 21, Qumei Home released the 2018 semi-annual financial report. The content shows that from January to June 2018, Qumei's performance growth faced great pressure, achieving operating income of 973 million yuan, an increase of 10.32% over the same period of last year; The impact of the expenses, the net profit attributable to shareholders of listed companies was 70 million yuan, a year-on-year decrease of 33.33%.

Qumei said in the explanation of the reasons for the change in gross profit margin that Qumei's gross profit margin for the period was 36.89%, compared with 38.30% for the same period of last year. The gross profit margin for the period was 1.41% lower than that of the same period of last year, mainly for sample cleaning and labor costs increased of the direct storefront North Fifth Ring storefront and north Four Ring store in Beijing.

In recent years, in the context of consumption upgrading, in order to cater to the market demand and consumption habits of the new retail era, Qumei has accelerated the integration of online and offline, and proposed a new product, new model, new value to establish a new Qumei strategy.

Qumei Home said that 2018 is a key period for continuously promoting the "New Qumei" strategy, deepening internal reforms and promoting digital management upgrades. However, from the financial report of the first half of 2018 that Qumei just handed over, the net profit fell by 33.33% compared with the same period of last year. It seems that the results are not satisfactory. Moreover, from the overall data growth of Qumei in the past two years, although the revenue amount has maintained a small increase, the year-on-year growth of revenue has been flat, and the net profit has been declining year by year.

Qumei Home said in the discussion and analysis of its operation situation that since the second half of 2017, the prosperity of the industry has declined. On the one hand, affected by the national macro-control policies, the real estate market has entered a downward cycle, and the demand for furniture market has increased. On the other hand, as more and more furniture companies land in the capital market, competitors have increased the promotion of retail terminals and accelerated the expansion of channels, and the competition in the furniture industry has become increasingly fierce. This may be one of the reasons for the new strategy of Qumei Home.

In June of this year, Qumei Home spent 4 billion rmb to acquire the Norwegian brand Ekornes. As the largest overseas M&A case in the industry, is there any doubt that Qumei Home has enough strength to introduce foreign brands into China?

(Source: JJgle.com)

You May Like

-

Qumei Home acquires 40% equity of "Henan Evergrande Qumei" for 72 million yuan

-

Qumei builds product + channel "dual core" drive, its performance ushered in an upward turning point

-

Qumei debuts at DDS contemporary home furnishing trend concept exhibition

-

Qumei Home Furnishing discloses Ekorne's 2020 financial report: revenue of 2.689 billion yuan, net profit of 110 million yuan

沪公网安备31010402003309号

沪公网安备31010402003309号